Practice Management Content

ExploreBLOG POSTS PUBLISHED SINCE INCEPTION

The Profit vs. Growth

Balancing Act

Every business owner struggles with the profit vs. growth conundrum: When is it best to prioritize lean operations to maximize profits and cash flow, and when is it necessary to prioritize...

The Power of Silence: Turning Off

Notifications Enhances Productivity

In today’s fast-paced and hyper-connected world, distractions seem to be everywhere, hindering our ability to stay focused and be productive. With notifications from apps and devices constantly...

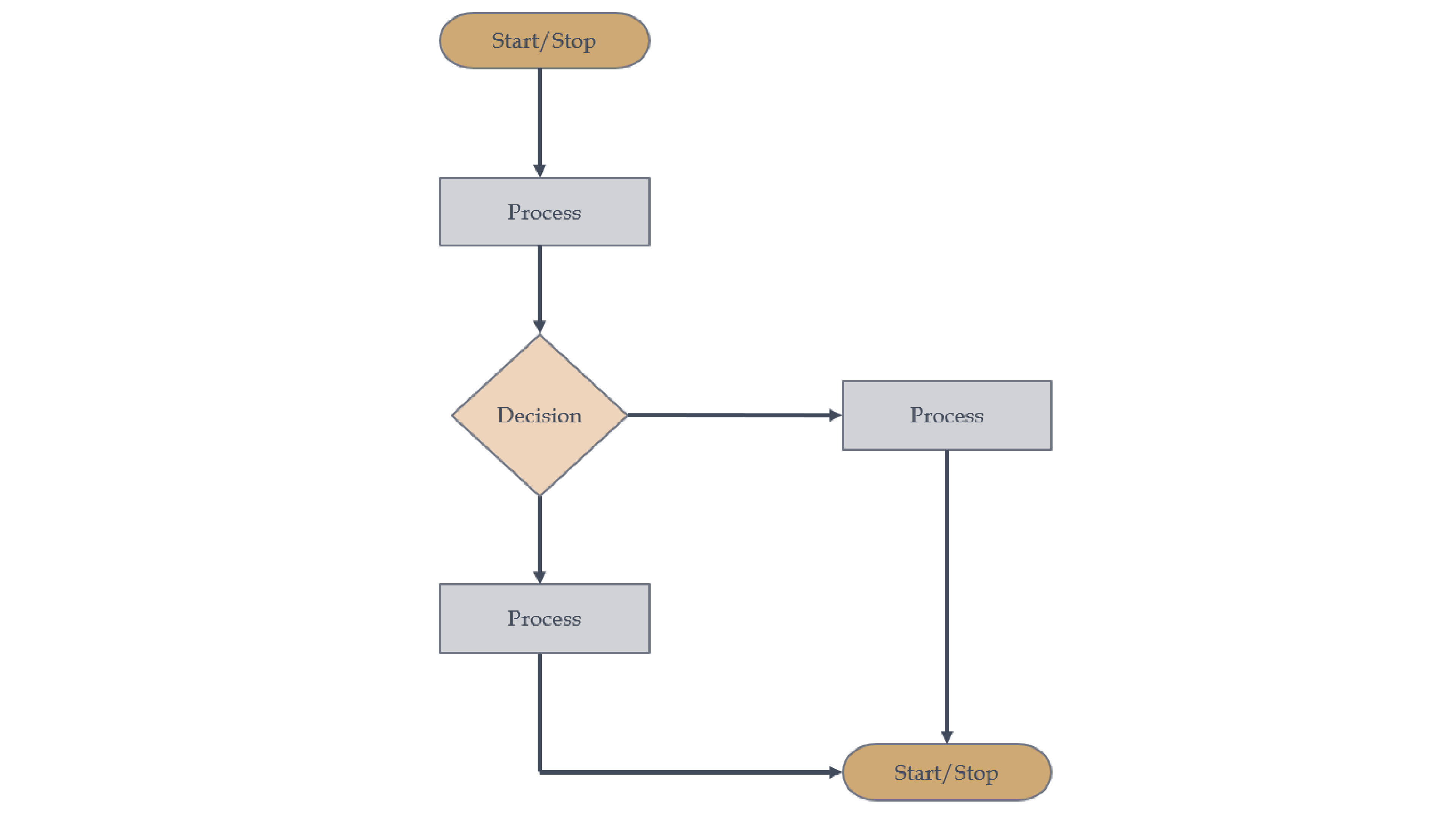

Importance of Documented Processes

in an Operations Manual

The goal of every RIA operations professional is to add efficiency and scalability to their organization. Said differently, we want to find a way to serve more and more clients without our level of...

Founder’s Bias and the COO Dilemma

Earlier this month, we released our 5-year anniversary episode of the COO Roundtable Podcast. Feeling somewhat sentimental during the recording, I read a few sentences from our...

Use The Summer Slowdown

To Conduct a Fee Audit

Many RIAs look to tackle operational projects during the summer months, when inbound client requests inevitably slow down due to travel plans and family vacations. With one more month left in the...

Client Niche: Everyone’s Talking,

No One Is Listening

Most sales and marketing experts will say the secret to organic growth for a service business is having a clear understanding of who your ideal client is and what unique services you can offer to...

Now Is the Best Time in a Decade

to Raise Fees

One common topic of discussion at financial advisor conferences is fee compression vs. margin compression. Several years ago, the industry press was predicting that robo advisors and the...

Common Drivers of M&A Activity

From a Buyer’s Perspective

The current state of RIA M&A activity seems to be a hot topic in the press these days. While rising interest rates and a slowing stock market are sure to dampen the record-breaking pace of...

Do Your Team a Favor,

Learn to Delegate

Advisors have been asking Matt Sonnen, CEO of PFI Advisors, for an outsourced COO offering since he launched two years ago. He’s no longer fighting the market…

The COO Roundtable

Episode 51

For our 51st episode, Matt welcomed two operations professionals who run relatively new firms, Vince Crane, COO, CCO and Partner of Flower City Capital and Zach Morris, Managing Partner and Founder...

Top 5 Lessons Learned from Episodes 46-50 of The COO Roundtable

With another batch of podcasts in the books and now four years of consistent, monthly episodes, we’d like to once again thank everyone who has listened, subscribed, and given feedback on The COO...

Why Employee Development is

Vital to RIA Growth

In late 2021 we urged RIA owners to, “Wake Up and Smell the Talent Shortage.” At the time we wrote, “Many RIA owners have their heads in the sand and don’t believe they need to court employees with...

The COO Roundtable

Episode 50

For our milestone 50th episode, Matt is joined by two guests who are equally committed to highlighting the importance of professional management across the RIA industry: Allison Felix, Managing...

Business Lessons from MrBeast:

The Power of Vision

Your definition of success must be defined and agreed upon before you set out on a business journey. For those of you with children under 15 living in your home, you are probably familiar with...

Is More Diligence Needed, Or Are

You Simply Stalling a Decision?

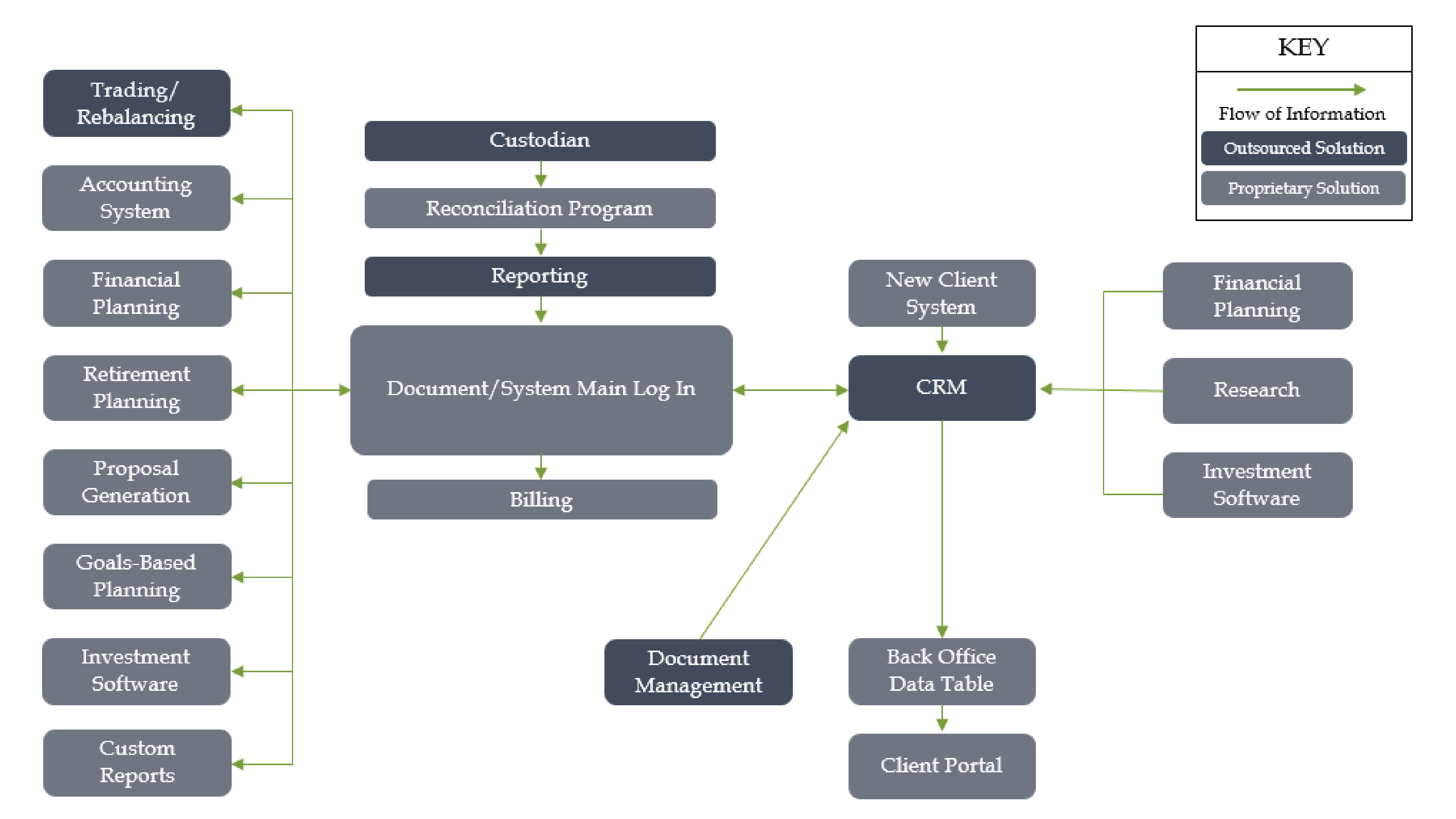

Members of The COO Society often hear me say, “Choosing technology tools for your RIA is relatively easy (there aren’t that many technology tools to choose from!) but building processes around those...

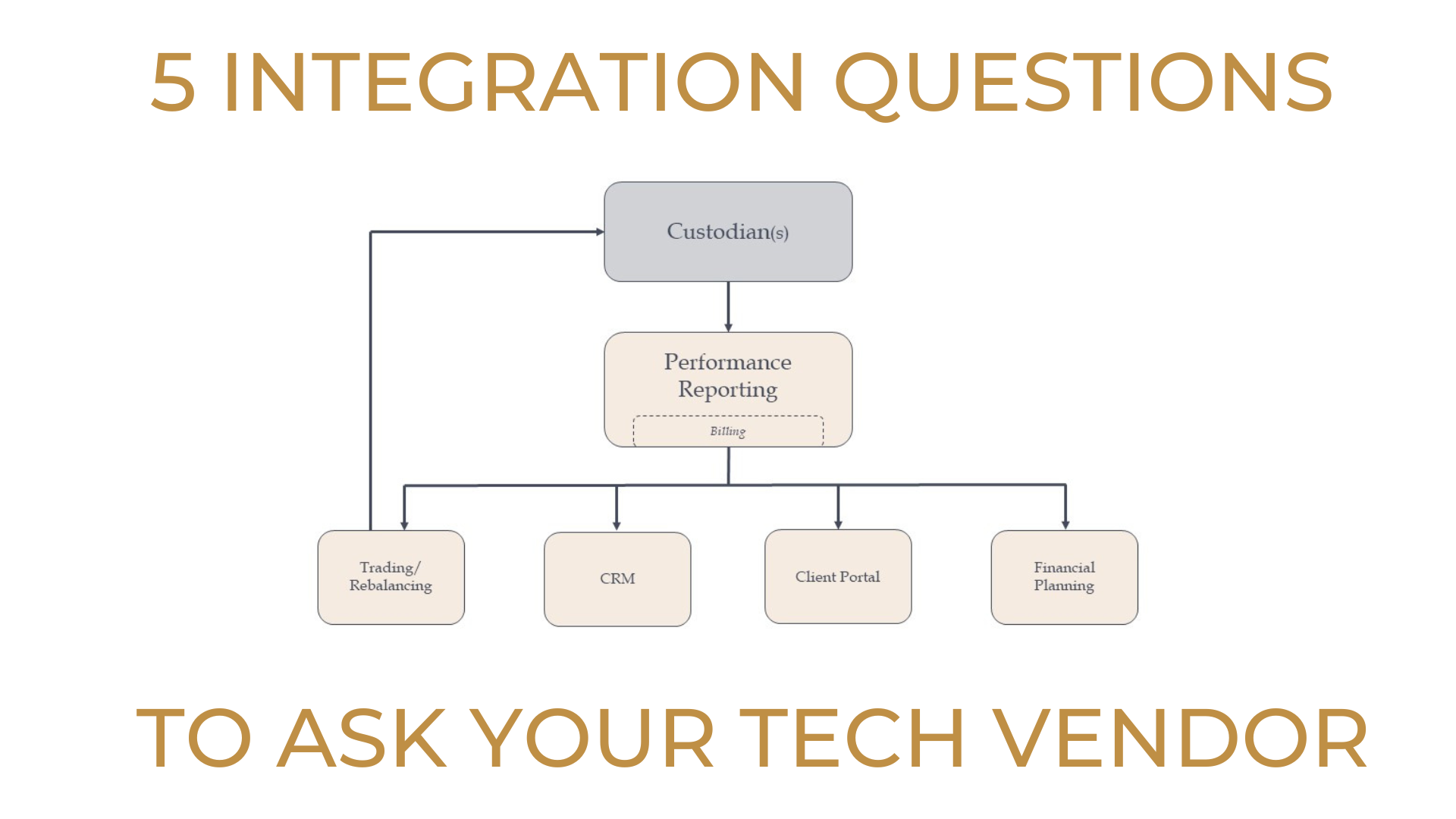

Key Questions to Ask Your

Tech Vendor re: Integration

“Integration” has become the key factor for RIAs as they build out their tech stack. Some firms will choose an all-in-one platform that provides all components of the technology back office under...

Advisors: Focus on Clients,

Not Data Entry (Trading)

As an RIA grows and more and more specialized roles begin to take shape across the organizational chart, advisors will gladly hand over the burdens associated with tasks such as employee onboarding,...

The Myth

of Outsourcing

Regardless of the nature of the task you are looking to outsource, there will always be components that will remain the responsibility of your internal team. As the RIA industry continues to grow...

The COO Roundtable

Episode 49

Our latest episode of The COO Roundtable features two guests who challenge our audience to think of the COO role in different ways - Edgar Collado of Tobias Financial Advisors and Alex Satterfield...

The Importance of Strategy

and How a COO Can Help

Recent research by Axos Advisor Services supported the importance of Operations professionals at RIAs by declaring that “71% of elite RIAs hire professionals to focus on operational issues, compared...

Guest Appearance: Michael Kitces’

Financial Advisor Success Podcast

It was an incredible honor for Matt to be a guest on Michael Kitces’ hugely successful podcast, the Financial Advisor Success Podcast. Matt and Michael spoke in detail about: The value...

Growing RIAs Must Focus on

‘Process,’ Not Technology

It is much less disruptive to take the time and train everyone on existing software tools than it is to convert to an entirely new system that requires you to transfer data along the way. RIA owners...

The COO Roundtable

Episode 48

For our first podcast of the new year (and our fourth year running!), Matt is welcomed by two exciting guests – Daryl Seaton, President at Sowell Management, and Barrett Karvis, Managing Director...

Top 5 Lessons Learned from Episodes

41-45 of The COO Roundtable

With another batch of podcasts in the books and now four years of consistent, monthly episodes, we’d like to once again thank everyone who has listened, subscribed, and given feedback on The...

The COO Roundtable

Episode 47

For our final episode of 2022, we were joined by two incredible members of our COO Society community: Julie Allen, Vice President of Business Operations at FirstWave Financial and Chris Pelch, Chief...

Checklist for Evaluating

Outsourced RIA Vendors

The SEC recently proposed a new rule offering further guidance on the due diligence process expected of RIAs when they are evaluating third party vendors used in their regular course of business....

Job Descriptions Aren’t Just

For the Hiring Process

They can lay out functional responsibilities and expectations for everyone in an organization. Between The Great Resignation, Quiet Quitting, and the surge in growth the RIA industry has experienced...

The COO Roundtable

Episode 46

Our latest episode of The COO Roundtable features a rare single-guest format. Stacey McKinnon of Morton Wealth recently wrote an important paper titled, “Your Career is Up to You” which features...

An Alternate Way

to Ask for Referrals

When asked how organic growth is achieved, advisors always point to referrals from centers of influence and/or clients. According to Schwab’s most recent benchmarking study, referrals account...

Tracking Time Spent Per Client:

Valuable Data or Waste of Time?

As Operations consultants, a primary question often posed to us from RIAs is, “How do we service more clients without our level of service dropping?” Technology and workflows, no doubt, can...

Strategic Planning for 2023:

Think ‘What’ Not ‘Why’

The conversation shouldn’t be about “How are we going to get more?” it needs to be, “What do we want more of?” The calendar has officially rolled into the fourth quarter of 2022, which means many...

The COO Roundtable

Episode 45

Our latest episode of The COO Roundtable features two leaders of relatively young and evolving RIAs. We are joined by Michael Wagner, Co-Founder and Chief Operating Officer of Omnia Family Wealth...

Evaluating Employees the EOS Way:

Get it, Want It, Capacity to Do It?

Many of the guests on our COO Roundtable podcast, as well as several of our RIA clients, run their businesses on the Entrepreneurial Operating System (“EOS”), made famous in Gino Wickman’s book,...

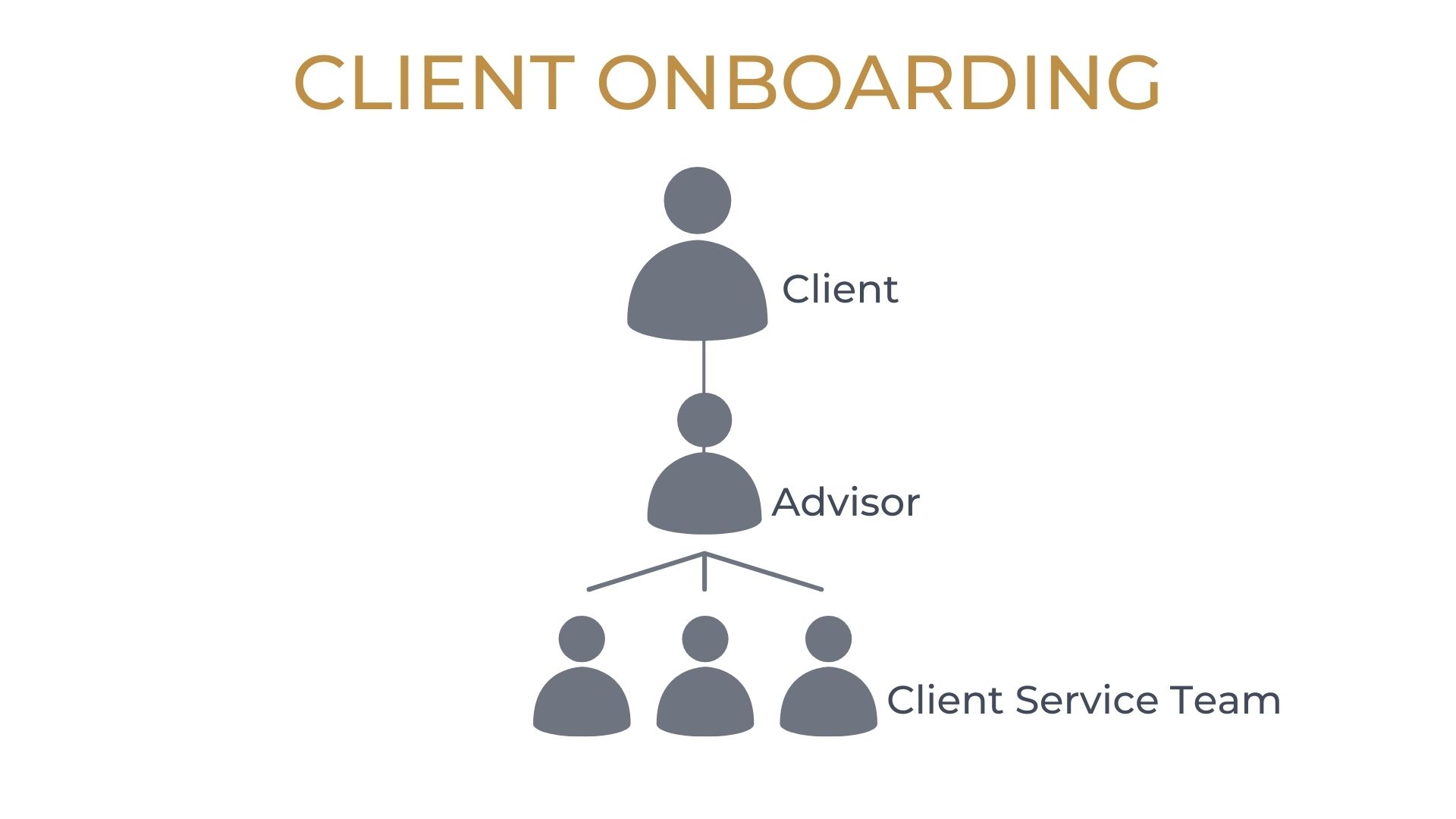

Client Onboarding: You Can Never

Make A Second First Impression

We are often contacted by RIAs that ask us to perform an assessment of their technology, their processes, and their people. Typically, we’ll start that analysis by asking the firm’s owners to...

The Behavioral Side

of M&A

A good cultural fit is key to the success of a merger. Day 2 of the Echelon Deal & Deal Makers Summit included a fantastic session moderated by Katie Johnson of FiComm Partners with Herbers...

The COO Roundtable

Episode 44

In the “Reggie Jackson episode” of The COO Roundtable, Matt welcomes two thoughtful leaders of their organizations, Principal and Chief Compliance Officer of SYM Financial Advisors, Crystal...

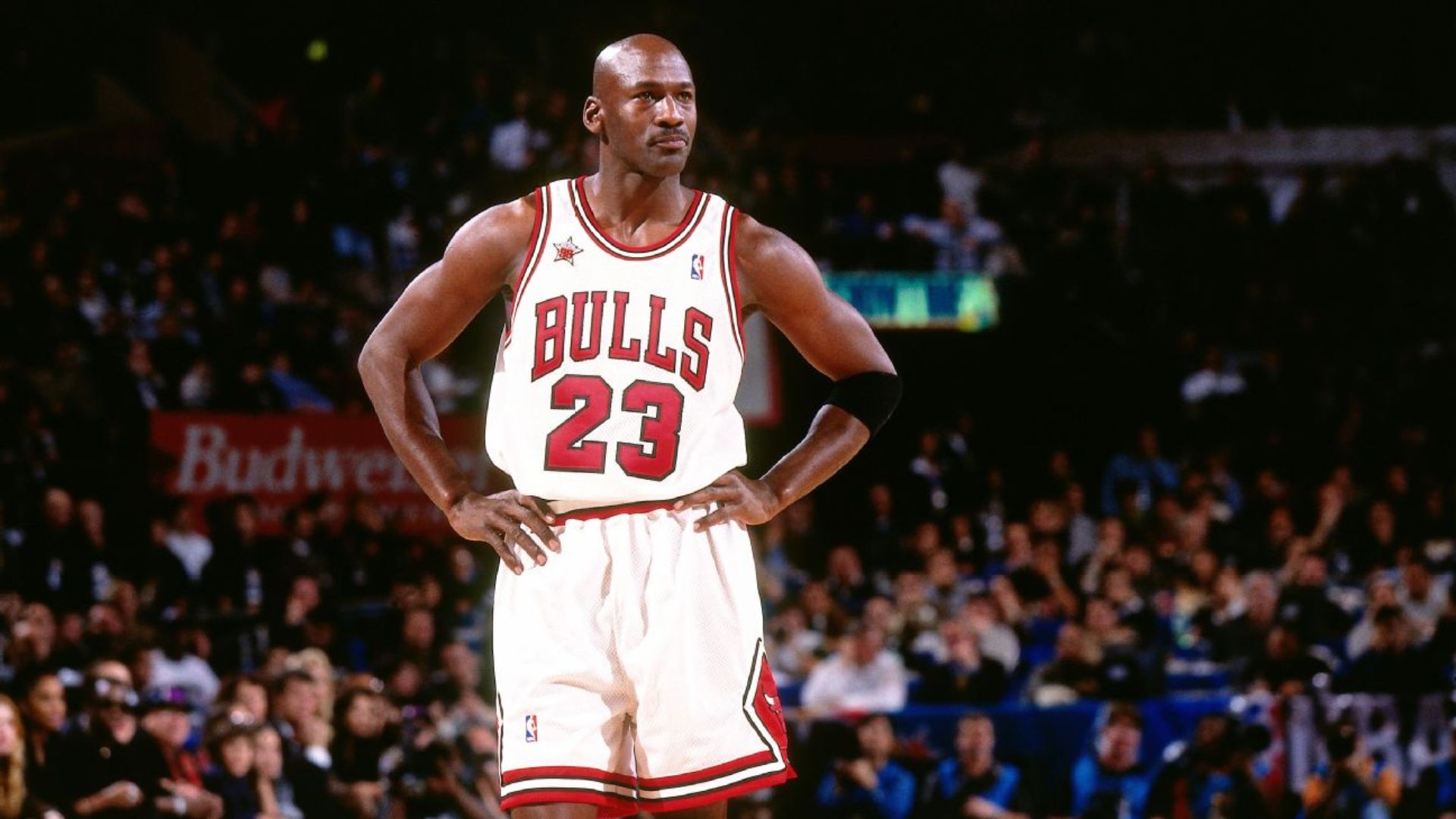

“Winning Has a Price…”

– Michael Jordan

I recently completed my third viewing of the 10-part documentary series, “The Last Dance,” detailing the Chicago Bulls’ 1998 championship season, and highlighting Michael Jordan’s entire...

Cover Letters Are Crucial

To the Hiring Process

At RIAs, they’re an indispensable way to find out more about potential hires than what’s just on a resume. While scrolling through LinkedIn recently, I came across a headline, “Recruiter shreds...

The COO Roundtable

Episode 43

In our latest episode of The COO Roundtable, Matt welcomes two impressive guests: Amanda Barrale, Chief Platform Officer of Moneta and Eric Sontag, President and Chief Operating Officer of...

25 Lessons From 25 Years

In Wealth Management

This month marks my 25th anniversary in the wealth management industry. I started down this career path with Merrill Lynch in July of 1997 as a Wire Operator (you’ll have to look that job up – it no...

Understanding the Power

of a COO

It goes well beyond being able to reboot the router. Regular listeners to our COO Roundtable podcast have heard me make the claim many times that the average RIA owner drastically...

The COO Roundtable

Episode 42

In our latest episode, Matt welcomes two incredible guests: Kristie Clayton, Integrator at iMatter and the Visionary Forum, and Melissa Bushman, VP of Operations at AltruVista. Kristie’s experience...

The Complexities of Investing

in Alternatives

Advisory firms' challenges when it comes to alts range from getting access to investments, meeting minimums, figuring out how to subscribe and the headache of performance reporting. Ask any two...

Top 5 Lessons Learned from Episodes

36-40 of The COO Roundtable

With another batch of podcasts in the books and over three years of consistent, monthly episodes, we’d like to once again thank everyone who has listened, subscribed, and given feedback on The COO...

7-Point Checklist: Initial Setup

of Performance Reporting Tool

If you are a newly-launched RIA setting up your performance reporting tool for the very first time, or if you have acquired another firm and need to transfer and configure their data from their...

It’s Official! Client

Niche Drives Growth

Knowing exactly who are you trying to serve has benefits beyond just marketing. Speaking at an industry conference earlier this month, Mark Tibergien stated, “Firms that have a niche or technical...

The COO Roundtable

Episode 41

For the 41st episode of The COO Roundtable, Matt welcomes three special guests from Vestia Personal Wealth Advisors – CEO and Co-founder, Lauren Oschman, Co-founder and board member, Tommy Martin,...

The Complexities of Alternative

Investment Performance Reporting

PFI Advisors (“Promoting Financial Independence”) released today a new industry white paper on the complexities of reporting on alternative investments. This is the eleventh report in PFI’s...

Calendly is Technology That

Humans Aren’t Ready For…

I am fully prepared to take some heat for this article, as there are many financial advisors who tout Calendly as the most innovative tool they’ve added to their tech stack in several years, but as...

Beyond Embarrassing: Why Employee

Onboarding Needs to Up Its Game

The onboarding of an employee should start weeks before the new hire arrives in the office, not the morning of their hire date. One of the many great things about the RIA industry is our deep-felt...

The COO Roundtable

Episode 40

In the 40th episode of The COO Roundtable, Matt welcomes two extremely thoughtful and strategic guests, Yonhee Gordon, Principal, Chief Operating Officer, and Chief Marketing Officer of JMG...

The Definition of “Productive” is

Different In-Office vs. At-Home

Over the last few weeks, more and more RIAs have been heading back to the office workspace. For some this has meant returning to the office fulltime, for many others, the return has marked the...

Career Advice from

Twisted Sister’s Dee Snider

I recently stumbled across this tweet from Dee Snider, the lead singer of the 80’s “hair metal” band, Twisted Sister: To provide some back story, Twisted Sister rose to fame in 1984 with their third...

The Important Role Talent

Plays in M&A Transactions

For buyers and sellers, highlighting the talent up and down the organization is a powerful way to stand out among competitors. It has been widely reported that 2021 marked the eight consecutive...

The COO Roundtable

Episode 39

This month’s episode features two incredible guests: Rob Ziliak, Chief Operating Officer at Buckingham Wealth Partners and Ryan Armock, Head of Operations at Thrivent Advisor Network. Founded in...

Operations Has a

Branding Problem

Don't be gaslit into believing that operations should take a subordinate role to sales and relationship management. As many of our loyal listeners know, one of my favorite topics to discuss on...

The COO Roundtable

Episode 38

For our latest episode, Matt welcomes two fantastic guests: Jennifer Wagoner Kirksey, Managing Director of Wealth Operations at Tolleson Wealth Management, and Trevor Phillippi, Chief Operating...

What Will Be the RIA Industry’s

“Nirvana Moment?”

I think we all will remember March 17, 2020, and the fear it brought for all of our businesses. Would the market hold up? Would our employees be able to service clients while working from home? ...

Adding to Your Team? Consider a

Performance Reporting Analyst

It seems that every RIA reported record growth in both 2020 and 2021, and accordingly, every RIA is looking to add members to their team to help support the additional clients. Many firms are...

The Power Of

A Fee Audit

While no one likes having to conduct an internal audit, it is imperative that RIAs confirm (on a regular basis) that the fee rates written on their client contracts match those loaded in their...

The COO Roundtable

Episode 37

For our first episode of the new year, Matt welcomes two highly accomplished guests: Jason Mirabella, Chief Platform Officer of Wealthsource Partners, and Tom Preston, Director of Client Service of...

Wake Up and Smell

The Talent Shortage

Our industry has seen tremendous growth over the past two years, and it feels like every RIA in the country is reporting record years in terms of onboarding new clients and new assets under...

Top 5 Lessons Learned from Episodes

31-35 of The COO Roundtable

With another batch of podcasts in the books and almost three years of consistent, monthly episodes, we’d like to once again thank everyone who has listened, subscribed, and given feedback on The COO...

Compliance Manual as

RIA Operations Manual

Collaboration between compliance and operations is key. When PFI Advisors is hired to perform an Operational Diagnostic of an RIA, one of the important components of our assessment is a review of...

The COO Roundtable

Episode 36

For our special three-year anniversary episode, we put a twist to our regular format and Matt was joined by Karl Heckenberg, CEO and President of Emigrant Partners for a compelling conversation on...

Buyers, Sellers Must Determine

“Who’s Steering the Ship?”

Like with any relationship, it’s important to have those uncomfortable conversations early. We have previously written about the trials and tribulations of RIAs looking to merge businesses in the...

The COO Roundtable

Episode 35

In the 35th episode of The COO Roundtable, Amanda Green of Matrix Private Capital Group and Gary Davis Jr. of Satovsky Asset Management join Matt to discuss all things RIA operations and change...

How Note Taking Can (Hopefully!)

Keep My Head Straight

Previously on this blog, I detailed a strategy that I have implement which has resulted in a more productive and creative work week. Today, I want to share a strategy I am still struggling to...

Advisors, Follow Your Own

Guidance: Charitable Planning…

No matter how you view it, M&A activity in the wealth management space is at record levels. The latest Deal Book, published by Devoe & Company, concludes that “M&A activity is...

The Added Importance of CRM

Tech in a Post-COVID-19 World

Advisors are learning that their CRM doesn’t only help them keep track of clients, but of their employees, too. In a pre-COVID-19 world, due to its ability to track client relationships and...

The COO Roundtable

Episode 34

In the 34th episode of The COO Roundtable, Matt welcomes two amazing guests: Jenn Papadopolo, COO of RegentAtlantic, and Matt Wiles, COO of Crestone Capital. RegentAtlantic is headquartered in...

How I’ve (Casually) Used Time

Blocking To Boost Creative Output

Like many of you, I’m constantly asking myself, “How do I get more done each day?” One of the common questions I pose to our guests on The COO Roundtable podcast is “Tell me about your time...

The Two-Way Street of Employee

Performance Reviews

While providing feedback to employees about their job performance is valuable, it’s much more important to use this opportunity to allow employees to feel supported and heard. RIAs continue to miss...

The COO Roundtable

Episode 33

In the 33rd episode of The COO Roundtable, Matt welcomes two highly respected operations professionals: Jandy Rowe, Principal and Chief Operating Officer of Wipfli Financial Advisors, and Brad...

M&A Requires More Than

Securing Financing

What first-time buyers are missing is that, despite popular opinion, most transactions are not propelled solely by a seller’s desire for monetary gain – they simply want to feel that by joining a...

Fee “Compression” or

Fee “Justification?”

I was honored to participate in Addepar’s Discovery Week back in June, alongside Amy DeTolla of Focus Financial and Cameron Sheehan of Addepar. During our session, we covered many topics including...

The COO Roundtable

Episode 32

For the 32nd episode of The COO Roundtable, we wanted to pause from our regular interview format and answer some questions we have been receiving about our new digital consulting platform, The COO...

Top 5 Lessons Learned from Episodes

26-30 of The COO Roundtable

With another batch of podcasts in the books and more than two years of consistent, monthly episodes, we’d like to once again thank everyone who has listened, subscribed, and given feedback on The...

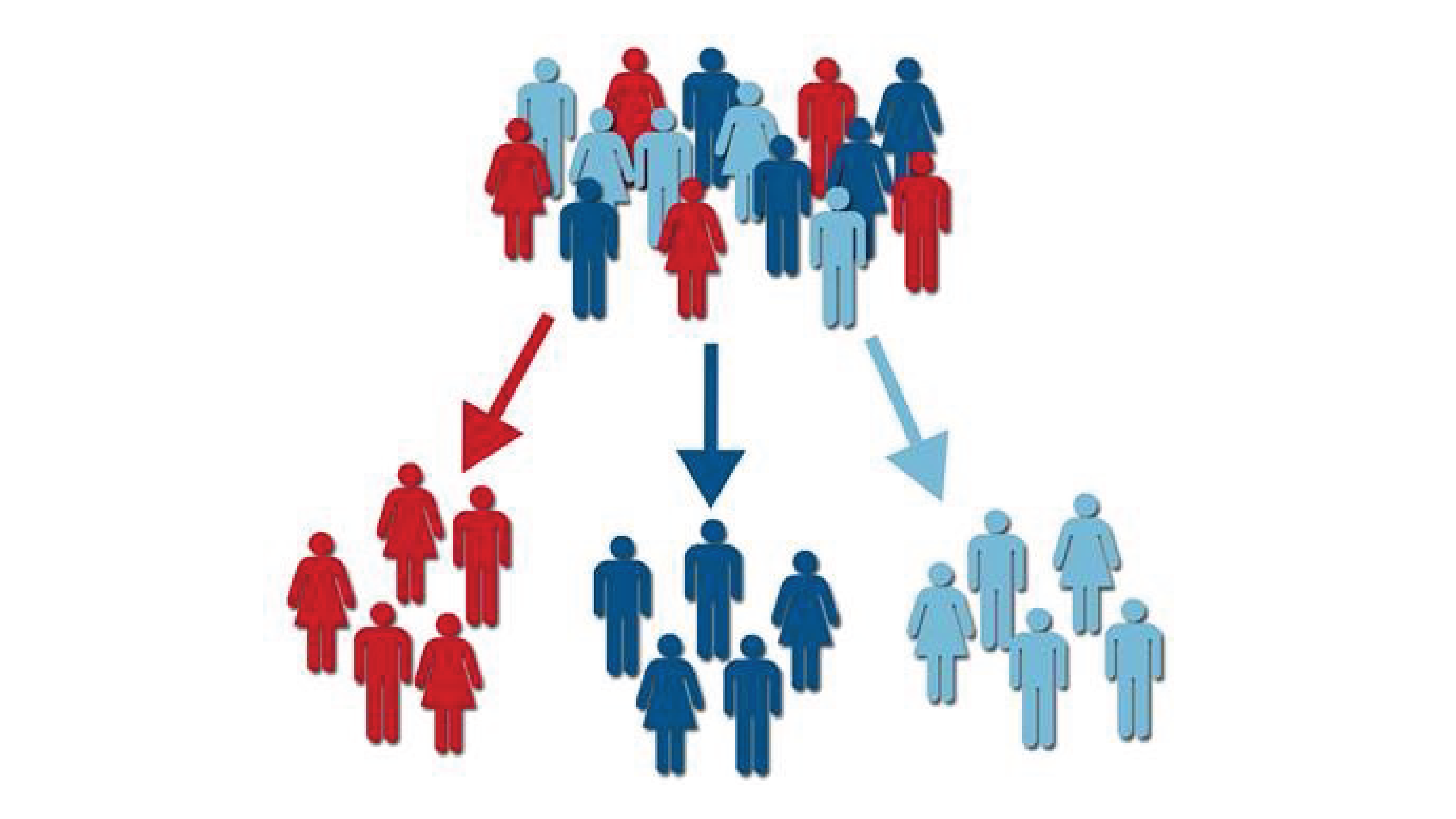

Client Segmentation

Is Not Evil

It's not personal, it's strictly business. Many RIAs struggle with profitability when they attempt to “be all things to all people,” which forces them to offer a wide range of services to clients of...

The COO Roundtable

Episode 31

In the 31st episode of The COO Roundtable, Matt welcomes two operations professionals who have had a huge impact on their respective organizations, Natalie Wheeler, Chief Operating Officer at...

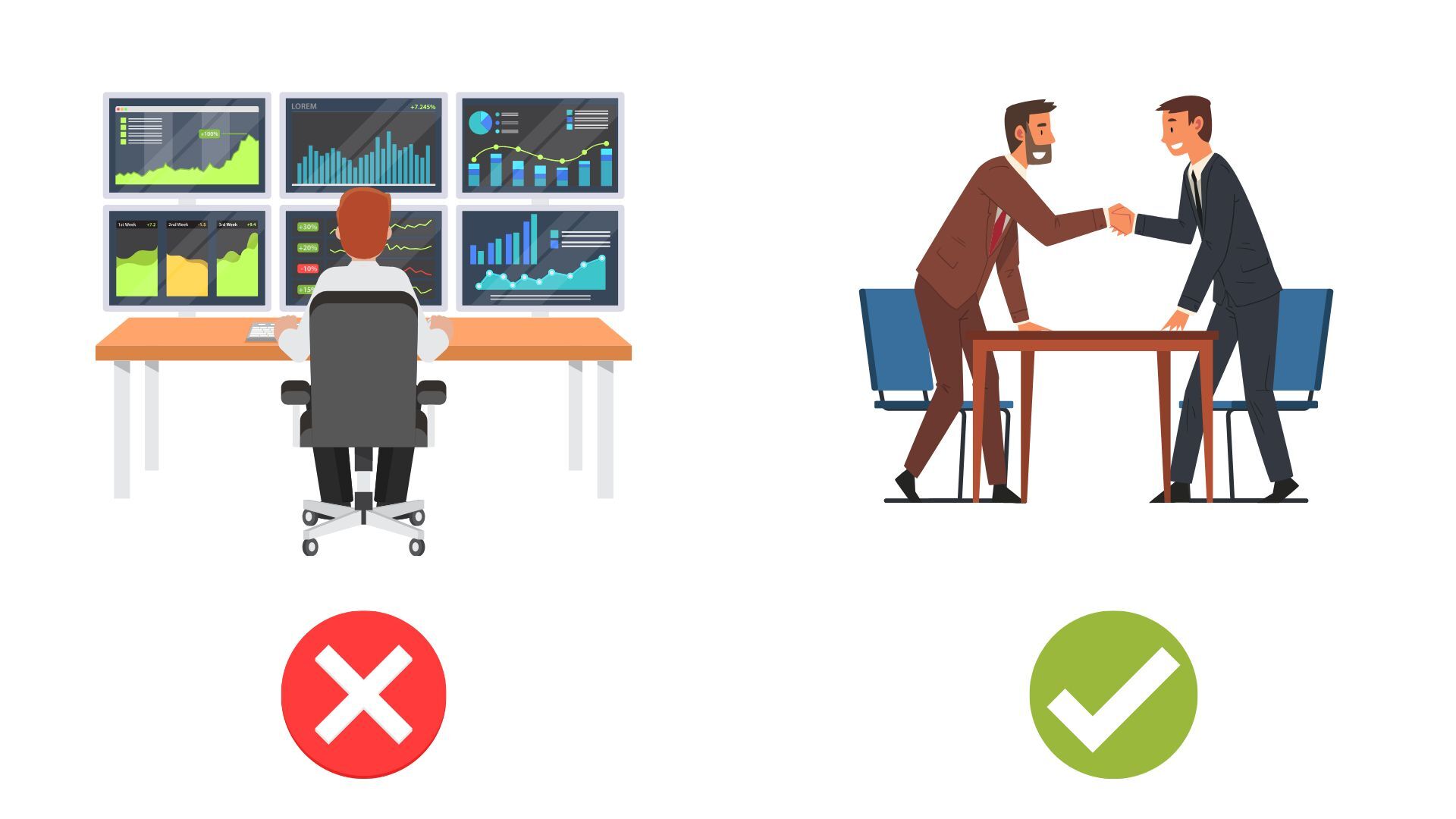

To Centralize or Not

To Centralize Trading?

Division of labor is wildly important if you are looking to grow and scale your business. Operationally speaking, it is the goal of every RIA to free up their advisors to focus solely on clients and...

As RIAs Evolve, C-suite

Specialization Begins to Emerge

When RIAs add professional managers beyond the founding group of advisers to add professional managers, they can finally achieve the levels of growth and profitability the advisers envisioned upon...

The COO Roundtable

Episode 30

In the 30th episode of The COO Roundtable, Matt welcomes Michael Paley, Chief Operating Officer at Klingman & Associates and Kevin Hrdlicka, Chief Operating Officer at Savant Wealth Management. ...

Hey Kids! This Is Why You

Want To Be An RIA COO

If you have ever listened to an episode of The COO Roundtable podcast, you’ve probably heard Matt joke that, “As a kid, no one says to themselves, ‘When I grow up, I want to the COO of an RIA...

Attempting to “Get It Done”

Every Single Day

Work-life balance is tricky for every professional, but 2020’s work from home environment and the added stresses of a global health scare made the past 14 months a truly unique time for all of us. ...

How Important Is it to

Define Your Ideal Client?

Knowing the type of client you are looking to serve will allow you to design the best products and services needed by them. When an RIA owner asks us to perform an Operational Diagnostic review of...

The COO Roundtable

Episode 29

In the 29th episode of The COO Roundtable, Matt welcomes two highly accomplished RIA professionals, Gina Bradley, COO & General Counsel of Colony Group and Susan Korin, COO & CCO of Balasa...

White Paper: The Role of

CEOs at Successful RIAs

Continuing our focus on professional management in the RIA space, we are proud to announce the release of our latest white paper (the tenth in our continuing educational series) highlighting the...

Top 5 Lessons Learned from Episodes

21-25 of The COO Roundtable

With another batch of podcasts on the books and two years of consistent, monthly episodes, we’d like to once again thank everyone who has listened, subscribed, and given feedback on The COO...

Joint M&A White Paper With

BNY Mellon | Pershing

We were extremely honored to partner with BNY Mellon|Pershing on their latest research report, “Why the Sale of Your Firm Should Be Viewed as a Catalyst for Growth.” Too often, advisors view the...

RIAs That Excel at Technology

Do Not Look Like Tech Firms

Technology should be used to enhance the advisor-client relationship but should never stand between the advisor and the client. I had the privilege of participating in Dimensional Fund Advisor’s...

The COO Roundtable

Episode 28

In the 28th episode of The COO Roundtable, Matt welcomes two extremely experienced consultants from Charles Schwab Advisor Services’ Business Consulting & Education division, Tony Parkin and...

“How Do I Find Good Operations

Team Members for My RIA?”

As the RIA industry continues to evolve and competition for clients (and advisors) increases, RIAs are realizing the importance of a dedicated Operations team that ensures that the trains are...

Entrepreneurial Advice From The

Craziest ‘80s Hair Band of Them All

“If you wanna live life on your own terms,You gotta be willing to crash and burn…” - “Primal Scream, ” Mötley Crüe, 1991 When most people hear the term, “entrepreneur,” the first names that come to...

Vendors & Consultants Can’t

Do The Push-Ups For You

One of the most popular articles we’ve ever written was titled ‘Integratable’ Does Not Mean ‘Integrated,’ But There’s Hope. The reason it resonated with so many readers is because advisors are...

What to Consider When Hiring

Your First Remote Employee

RIAs can benefit by increasing the talent pool beyond the geographic limitations of the firm’s physical office, but methodical planning and proper diligence are required to ensure success. ...

The COO Roundtable

Episode 27

For this special edition of The COO Roundtable, Matt recorded live from Mercer Capital’s inaugural RIA Practice Management Insight’s conference. This virtual conference “focused on back of the house...

Our Thoughts on

Content Marketing

Someone recently crinkled their nose at me and asked, “You’re an operations and technology/business consulting firm – why do you waste so much time on content marketing?” It’s a fair question, and...

Untold Truths Of Acting

In Your Clients’ Best Interest

Matt had the opportunity to sit down with Stacey McKinnon, COO of Morton Capital, to discuss her recent paper, “5 Untold Truths of Acting in Your Client’s Best Interest.” During their...

How Should an RIA

Rate Its COO?

A COO's role differs with each firm. That makes evaluating their performance all the more complex. During my recent interview with Lisa Cook of Pacific Portfolio Consulting and Erica Farber of...

The COO Roundtable

Episode 26

In the 26th episode of The COO Roundtable, our host, Matt Sonnen, welcomes Matt Ran, Chief Operating Officer and Partner of Telemus Financial Life Management, and Kelly Downs, Chief Operating...

Setting Expectations Early With

Outsourced Business Partners

I recently joined Rich DeSalvo of F3 Logic and Barrett Ayers of Adhesion Wealth for Adhesion’s monthly podcast, “Power Your Advice.” The topic of conversation was the benefits of outsourcing,...

The COO Roundtable

Episode 25

In the 25th episode of The COO Roundtable, Matt welcomes Lisa Cook, the newly-appointed COO at Pacific Portfolio Consulting in Seattle, WA and Erica Farber, Partner at Balentine in Atlanta,...

Top 5 Mistakes Buyers Make

When Integrating Acquisitions

These are the ways buyers and sellers commonly fall short when combining firms. 2020 was another banner year for M&A activity in the RIA industry, and while deal makers continue to build on the...

Book Review – Riding

Shotgun: The Role of the COO

PFI Advisors has written extensively about the COO role within an RIA firm. However, we are always seeking new perspectives by periodically examining this role’s impact on other industries and how...

The COO Roundtable

Episode 24

In the 24th episode of The COO Roundtable, which marks our podcast’s 2nd anniversary, Matt welcomes two prominent guests from Segall Bryant & Hamill: Chief Executive Officer Phil Hildebrandt and...

How 2021 Will

Differ From 2020

Regardless of what the pandemic will bring, or not bring, in 2021, the wealth management industry has been changed forever. Everyone is excited to turn the page on 2020. With several recent...

With or Without a Pandemic,

Employee Onboarding Can be Tricky

Your revenue-generating employees are just as important, if not more important, than your revenue-paying clients. Make sure they know that starting on their first day. Much has been written and...

The COO Roundtable

Episode 23

In the 23rd episode of The COO Roundtable, Matt welcomes Aiki Altmets, COO and CCO of the newly-formed Regimen Wealth and Lynne Born, President of Wealth Architects. Regimen Wealth is headquartered...

Identify Your Ideal Client Before

You Determine Your Tech Stack

Until an advisor can identify who they are serving and how they want to serve them, they cannot begin to build out a proper technology stack. We are often contacted by breakaway advisors...

Heartbroken

This tribute to Eddie Van Halen is going to seem silly to most readers, considering I never met the man, but the fact remains that I am absolutely devasted by the news of his passing today. ...

The COO Roundtable

Episode 22

In this special episode of The COO Roundtable, Matt recorded live for Bob Veres’ Insider’s Forum. For those unfamiliar with Insider’s Forum, it “is designed to provide essential information for...

Making a Big Firm

Feel Small

The continued tear of M&A activity throughout the RIA industry has resulted in some firms reaching critical mass very quickly. These firms are learning that with size comes all the...

Adapting Advisory Teams To A

Hybrid Office/Home Workplace

Matt was honored to partner with Stacey McKinnon, COO of Morton Capital, for this guest article on Kitces.com. Matt and Stacey reflect on the shift in workplace environment caused by the COVID-19...

RIA Owners Need To Realize That 75%

of a COO’s Job is Human Resources

As I declared when we launched the COO Roundtable podcast in late 2018, “Every advisory firm struggles with the goal of providing high-touch service to a...

Investment Philosophy Kills More

M&A Deals Than Valuation

If the collective vision for investment philosophy—who will be managing the portfolios and choosing what the best investments are for client portfolios—cannot be agreed upon, there is no reason to...

The COO Roundtable

Episode 21

In the 21st episode of The COO Roundtable, Matt welcomes Chris Keller, Executive Vice President and Director of Business Services at Benjamin F. Edwards & Company and Doug Johnson, newly...

Always Focus on

the Client Experience

Below is a long, harrowing, frustrating, and oftentimes sad recount of my recent interaction with Microsoft support for our son’s Xbox. As you will see,...

Top 5 Lessons Learned from Episodes

16-20 of The COO Roundtable

With our twentieth podcast in the books and a year and a half of consistent, monthly episodes, we’d like to once again thank everyone who has listened, subscribed, and given feedback on The COO...

The COO Roundtable

Episode 20

In the 20th episode of The COO Roundtable, Matt welcomes Diane Gabianelli, Co-President and Chief Financial Officer of Parallel Advisors and Cecilia Williams, Director of Investment Operations and...

Thinking of Selling? Focus on

Profits Before Hiring a Banker…

With RIA M&A activity at a frenzied pace, much has been written about how to best value an RIA business. Typically, a multiple is applied to either revenue or cash flow (profits). In...

Use the Summer Slowdown to Assess

Your Post-COVID Tech Policies

Every year, we recommend RIA leaders take time over the summer, when things inevitably slow down a bit, to take stock of not only their technology stack, but their policies, procedures, and various...

Merging? Employee Communication

Is More Critical Than Ever

As we have written in the past, M&A transactions can cause a tremendous amount of trepidation and angst among employees of both Buyer and Seller. While completely normal, the root of fear...

The Path to RIA Ownership

Through the Operations Channel

The RIA industry has always done a good job detailing the career path for those aspiring to become financial advisors and ultimately owners in their business. In fact, the Center of Financial...

The COO Roundtable

Episode 19

In the 19th episode of The COO Roundtable, Matt welcomes Michelle Thetford, Chief Operations Officer of HighTower Advisors and Michael Reed, Chief Operating Officer of Dakota Wealth Management. ...

Will COVID-19 Change

The Way We Work Forever?

While some RIAs were caught flat-footed when widespread stay-at-home orders were instituted across the country in March, most have reported a “better than expected” experience as clients have...

The New

RIA Workplace

PFI Advisors is proud to announce we have partnered with Stacey McKinnon, COO of Morton Capital for an industry research piece, “The New RIA Workplace.” While some RIAs were caught flat-footed...

Reporting Technology

for RIAs

When wirehouse or IBD advisors look to launch their own firm, the main question on their minds is, “How will I recreate the products and services I’ve always offered my clients throughout my career,...

The COO Roundtable

Episode 18

In the 18th episode of The COO Roundtable, Matt welcomes Steven Beals, Chief Administrative Officer of EP Wealth Advisors and Eric Hehman, Chief Executive Officer and Principal of Austin Asset. EP...

What Would David Lee Roth

Do If He Owned an RIA?

I was 9 years old when Van Halen’s masterpiece album “1984” was released. That album had the same effect on me as it did many people my age – it changed my...

The Importance of Reporting

Provider Technology for RIAs

PFI Advisors (“Promoting Financial Independence”) announced today the release of a new industry report (the ninth in its continuing educational series) on reporting provider technology available to...

The COO Roundtable

Episode 17

In the 17th episode of The COO Roundtable, Matt welcomes Vibhaw Arya, Chief Operating Officer at Shufro Rose and Brandon McKerney, Partner and Director of Operations at Columbia Pacific Wealth...

Working with Your Spouse May Be

Tricky, Except in a Global Pandemic

Over the past 4 ½ years many people have said to me “You work with your spouse?!? I could never do that!” And my humorous reply has always been, “What makes it work is that Reese works from home,...

Silver Linings: Using Crisis to

Improve Your RIA’s Health

This article is being published a bit early, I realize that. When you go to the doctor with clogged sinuses, a splitting headache, and body aches like you’ve never had, you just want some...

Top 5 Lessons Learned from Episodes

11-15 of The COO Roundtable

With our fifteenth episode and over a year of consistent, monthly releases, we’d like to once again thank everyone who has listened, subscribed, and given feedback on The COO Roundtable. We’ve...

The COO Roundtable

Episode 16

In the 16th episode of The COO Roundtable, Matt welcomes David Aaron, Partner at Cerity Partners* and Jim Atkinson, COO and Head of Mergers & Acquisitions at STA Wealth Management. Prior to...

How Top RIA COOs Are

Responding to COVID-19

Every RIA needs a Business Continuity Plan (it’s SEC-required) and most RIAs are good about updating it every year when they perform their annual compliance review…

Pivoting Quickly To A

“Work From Home” Model

With the coronavirus pandemic triggering widespread quarantines, many advisory firms are implementing measures to set up their operations as a Work-From-Home (WFH) environment. We partnered with...

Why Every RIA

Needs a Data Analyst

From social media giants to your local grocery store, these days everyone is looking to gather and use client data to run their businesses better— and your RIA should be no exception. Any RIA not...

Client Portal:

Build or Buy?

RIA publications and the conference circuit are filled with articles and breakout sessions titled, “The Digitization of Advice” or “The Amazon and Netflix Effect on Our Industry” – all…

The COO Roundtable

Episode 15

In the 15th episode of The COO Roundtable, Matt welcomes Loren Pierson, COO of Mercer Advisors and Michael Kossman, COO, CCO, and Partner of Aspiriant. A trailblazer in…

Gratitude

& the Mamba Mentality

Yesterday was Kobe Bryant’s memorial service here in Los Angeles. On January 26th Kobe, along with his 13-year-old daughter, Gianna, and 7 others tragically...

Operational Excellence

Drives Sales Growth

There is a friction that commonly exists within many organizations, and it occurs between the sales department and the back-office operations department. Both feel underappreciated by the...

The COO Roundtable

Episode 14

With M&A activity at an all-time high and no sign of stopping anytime soon, we take a break from our usual interview format here in Episode 14 and Matt speaks directly to our listeners about the...

Mark Tibergien Provides RIA COOs

6 Metrics to Define Their Value

I had the distinct pleasure of interviewing Mark Tibergien and Karen Novak of BNY Mellon Pershing, Advisor Solutions for Episode 12 of our podcast, The COO Roundtable. One of the main goals of the...

A Gen Z Perspective

on the RIA Space

Proud of your latest Millennial hire? You may want to consider the fact that Gen Z, the generation after Millennials, has already begun graduating college and are looking for our first...

Post-Merger Integration:

“Yes” is Nothing Without “How”

In his book on negotiation, “Never Split the Difference,” former FBI hostage negotiator Chris Voss states that, “’Yes’ is nothing without ‘How.’” Voss, who made a living brokering some of the...

The COO Roundtable

Episode 13

In the 13th episode of The COO Roundtable, Matt welcomes Kristi de Grys of Merriman Wealth Management and Larry Miles of AdvicePeriod. After spending almost two decades in the aerospace industry,...

CCOs Help Drive Growth

at RIAs (Really!)

PFI Advisors continues to tout the benefits of professional management for RIAs. As Rich Gill of Wealth Partners Capital Group recently stated on the Mindy Diamond on Independence podcast, the...

What is Advisors’

Time Worth?

Following the success of our COO white paper and personal enjoyment of interviewing the profiled COOs at the end of 2018, we at PFI Advisors declared 2019 to be “The Year of the COO.” We...

The COO Roundtable

Episode 12

In the 12th episode of The COO Roundtable, Matt welcomes Mark Tibergien and Karen Novak of BNY Mellon Pershing.* Mark, CEO, Advisor Solutions, BNY Mellon Pershing is a monumental figure in the RIA...

A Deeper Look Into The Role of

Chief Compliance Officers at RIAs

PFI Advisors (“Promoting Financial Independence”) announced today the release of a new industry report (the eighth in its continuing educational series) highlighting the growth opportunities CCOs...

The COO Roundtable

Episode 11

In the eleventh episode of The COO Roundtable, Matt welcomes Kelli Cruz, CEO of Cruz Consulting and Jim Regitz, Founding Partner and Senior Advisor at…

Top 5 Lessons Learned from

Episodes 6-10 of The COO Roundtable

With ten episodes now under our belt, we’d like to once again thank everyone who has listened, subscribed, and given feedback on The COO Roundtable.

High Tech vs. High Touch: What

Are Clients Really Asking For?

Technology isn't developed to replace human interaction, but rather to enhance it. At the Envestnet conference this past May, the late Jud Bergman was asked about his thoughts around technology’s...

The COO Roundtable

Episode 10

In the tenth episode of The COO Roundtable, Matt takes some time to reflect on some of the highlights and biggest takeaways from the nine content-packed episodes we’ve produced so far and he even...

The Fear of Change, Part 2:

The Emotions of New Technology

The Fear of Change: A 3-Part Series for RIAs As the RIA industry matures, consolidates, grows, and evolves, many of our clients contemplate M&A transactions, changing their technologies or...

The Fear of Change, Part 1:

The Emotions of an M&A Transaction

The Fear of Change: A 3-Part Series for RIAs As the RIA industry matures, consolidates, grows, and evolves, many of our clients contemplate M&A transactions, changing their technologies or...

New RIA COO? How to

Prepare for Success on Day 1

In the eighth episode of The COO Roundtable, featuring David Canter and Scott Slater of Fidelity Clearing & Custody Solutions…

The COO Roundtable

Episode 9

In the ninth episode of The COO Roundtable, Matt welcomed Susan Dickson and Suzanne Williamson, principals of Private Ocean. Susan is the Chief Operating Officer of the firm, and Suzanne is...

RIAs Are Struggling with Too Much

Technology, Not Too Little

The objection we hear most often from prospective clients (delivered in a sarcastic tone) is, “I don’t want to hire an operations and technology consultant. Not only do I have to…

Integratable ≠ Integrated

But there is hope

In our work with new and established RIAs looking to build and/or improve their technology stack, we encounter many frustrated advisors who lament, “We were told that the benefit of being an RIA was...

What RIAs should learn

from Uber and Lyft

Most RIA owners are obsessed with growing top-line revenue at all costs, with little thought to the bottom-line profitability of each additional dollar of AUM A recent New York Times article called...

The COO Roundtable

Episode 8

In the eighth episode of The COO Roundtable, Matt sat down with David Canter and Scott Slater of Fidelity Clearing & Custody Solutions. David is the Executive Vice President and Head of the RIA...

Where to Start When

Developing Workflows

In our work with large RIAs looking to increase their scale and efficiency, we often begin with a review of their various systems, people, and processes. We walk through…

The American Dream, Through

the Life of Geremia Papa

This is my grandfather, Geremia (“Jerry”) Papa. He arrived in the United States in 1920, at the age of 18, from his homeland of Italy. My mother assures me that “Papa” is his real last name, but...

Don’t Charge for Reporting

On Outside Assets

Advisors looking to grow their business must constantly grapple with client acquisition costs. As advisors struggle to differentiate themselves and the services they offer, many have concluded that...

The COO Roundtable

Episode 7

In the seventh episode of The COO Roundtable, Matt sat down with Heather Goodman of True Capital Management and Mark DeLotto of Massey Quick Simon. Heather is the COO, President, and Co-Founder of...

Two Key Ingredients to

a Proper M&A Strategy

Not a day goes by that the RIA press isn’t reporting on another merger or acquisition. At industry conferences, the panels discussing M&A are the most highly attended. With more and...

The COO Roundtable

Episode 6

In the sixth episode of The COO Roundtable, Matt was excited to welcome the first CEO to the Roundtable discussion! Jeff Concepcion, Nancy Andrefsky, and Lou Camacho from Stratos Wealth Partners...

Top 5 Lessons Learned from Episodes 1-5 of The COO Roundtable

We’d like thank everyone who has listened, subscribed, and given feedback on The COO Roundtable thus far. We’ve really enjoyed conducting these interviews and hearing all your reactions. ...

The COO Roundtable

Episode 5

In the fifth episode of The COO Roundtable, host Matt Sonnen was thrilled to sit down with Heather Fortner of SignatureFD and Lucas Winthrop of Winthrop Wealth Management. SignatureFD,...

Book Review: The Financial Advisor M&A Guidebook

PFI Advisors has written a lot around the operational side of M&A, and how important it is for firms to think through not only deal structure and valuation, but the planning process around...

Why is an Ops & Tech Consultant Writing About Client Segmentation?

Anders Jones of Facet Wealth recently wrote that as RIAs approach the elusive $1 billion AUM milestone, they need to be increasingly cognizant of their profit margins and resources needed to service...

The 3 Most Common Technology Headaches RIAs Face

Technology reporter Ryan Neal’s recent article offered a refreshing (and interesting) perspective of problems RIAs often face with their technology suite of systems. He provided an...

The COO Roundtable

Episode 4

In the fourth episode of our podcast, The COO Roundtable, Matt sat down with Tom Harms of Summit Trail Advisors and Stacey McKinnon of Morton Capital Management. Summit Trail Advisors manages about...

5 Building Blocks to Becoming a Successful Buyer

There are more than 12,000 SEC-registered investment advisors[1] in the United States trying to differentiate and grow their businesses across the competitive and fragmented RIA space – a...

Why Professional Management

Fails for RIAs

We have written much about the benefits of professional management for RIAs. By bringing in professional management, the owners/advisors of the firm are availed of the day-to-day burdens of running...

The COO Roundtable

Episode 3

In the third episode of our podcast, The COO Roundtable, Matt was thrilled to sit down with Trevor Chuna and Shaun Kapusinski of Sequoia Financial Group, an RIA in Akron, OH managing over $4...

5 Building Blocks to Branding Yourself a Successful Buyer

As we announce our latest co-written white paper, we thought we would first share some background research and history put into this particular M&A thought leadership piece. While this is...

The COO Roundtable

Episode 2

In the second episode of our podcast, The COO Roundtable, host Matt Sonnen sits down with Gary Bonner of Avalon Advisors and Mike Lee of LourdMurray. Also featured in our most recent white paper,...

The COO Roundtable

Episode 1

In our inaugural episode, Matt sits down with Jeff Fuhrman of Coastal Bridge Advisors and Tony Craun of Sand Hill Global Advisors. These two were gracious enough to be profiled in our latest white...

Industry Coverage of PFI Advisors’ Recent COO White Paper

In late October, we released our latest white paper, “Exploring the Benefits of Professional Management for RIAs: A Deeper Look into Chief Operating Officers,” the sixth installment in our industry...

Introducing The COO Roundtable Podcast

I am thrilled to announce the launch of The COO Roundtable, our latest endeavor in championing the role of operations…

Are You Serious, Wall Street? A Response to Men’s #MeToo ‘Advice’

This open letter is a response to a Bloomberg Article InvestmentNews ran Tuesday about some male Wall Street executives whose concerns about #MeToo accusations have led them to limit the ways...

A Different Kind of #GivingTuesday Campaign

PFI Advisors will be participating in this year’s #GivingTuesday in a very meaningful way. Any RIA that donates $10,000 or more to the Children’s Hospital Los Angeles donation page of...

A Deeper Look Into Chief

Operating Officers at RIAs

PFI Advisors ("Promoting Financial Independence") announced today the release of a new industry report (the sixth in its continuing educational series) on an often overlooked topic facing...

Five Questions to Ask About Your Technology Infrastructure

RIAs regularly review their clients’ financial goals and portfolios. They should also service themselves with the same care and consistency with an internal review of their technology...

The Age-Old Debate: Profit vs. Growth – What’s More Valuable?

At the Echelon Deal and Deal Makers conference in Newport Beach earlier this month, several sessions tackled the big question: If I’m looking to sell my firm, what is more important to a buyer - my...

Dual-Contract SMAs vs. Single-Contract SMAs

The most common question we receive from breakaway advisors is, “If I start an RIA, how do I recreate the products and services I’ve always had available to me during my career in the wirehouse?”...

“M&A Through the

Operational Lens”

We have been long-time proponents of the notion that RIAs need top tier technology infrastructure to support growth through M&A. Many would-be Buyers mistakenly think…

Far from Forgotten: The Impact Layla Paige Sonnen Has Made

Layla – you left us one year ago, at 3:58am on July 8th, 2017, in your mother’s arms, surrounded by your dad and big brother Luke, and more love than we ever thought possible. There was no...

Harnessing RIA M&A strategies for growth

With the RIA industry setting itself up for further consolidation based on the macro trends impacting the industry, the opportunity for peer-to-peer M&A activity is increasing dramatically....

Advisors Explain How They Made An Acquisition Work

Karen DeMasters of Financial Advisor Magazine detailed the strategies used by some of the most successful RIA acquirers in our industry. We were honored to cover these firms in our most recent...

PFI Advisors White Paper: Becoming a Professional Buyer Part 2

We are excited to present the latest installment in our “Becoming a Professional Buyer” research series. This white paper highlights five industry leaders and the lessons they have learned...

3 Requirements for Successful Project Management

As an operations and technology consulting firm that works with both breakaway advisors and existing RIAs in growth mode, we have become adept at project management and the importance of maintaining...

Mark Tibergien’s Latest Book Could Put RIA Consultants Out of Business

As a consultant to both breakaway advisors and RIAs, some may question my title to this article, and others may question my timing, as “The Enduring Advisory Firm: How to Serve Your Clients More...

“Between Now and Success” Podcast, a Discuss on RIA Technology

With the accelerating pace of technological change, how can you be sure you are making the right technology choices? What should your tech stack look like? One of the biggest changes in the...

Alt investments on the rise among RIAs

We wrote this article for InvestmentNews to highlight the research we conducted for our Alternative Investments White Paper last October, where we highlighted the alternative investment resources...

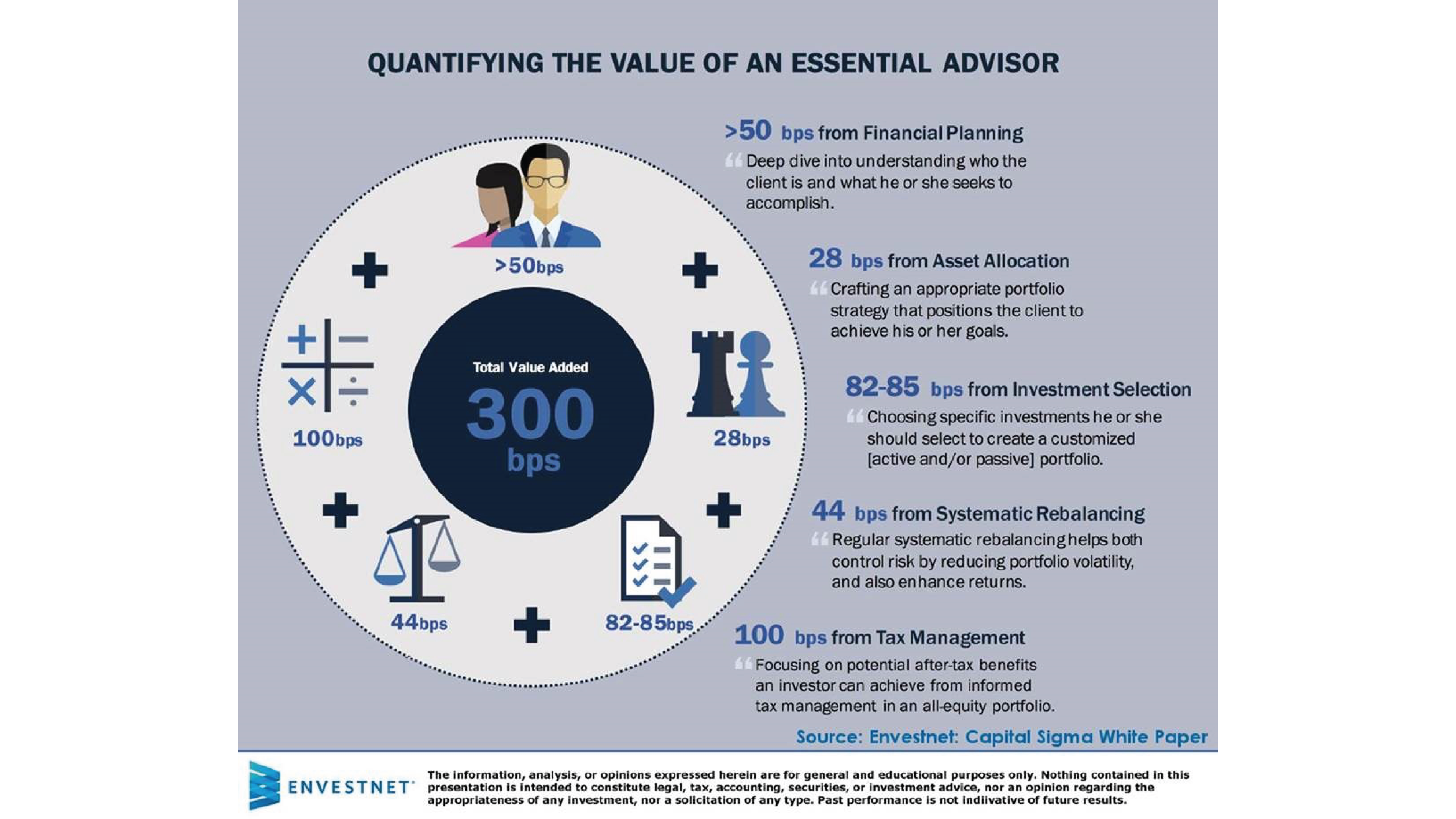

What Are Clients

Willing to Pay For?

While attending Schwab IMPACT last month, we had the privilege of listening to a presentation by Joe Duran, CEO of United Capital. In his opening remarks, he compared Vanguard in the financial...

Jumping into

the M&A Game

As operational and technology consultants, we are contacted at least three times per month from larger RIAs saying, “A friend of mine just bought a $100 million practice – I want to do that too!”...

How RIAs Can Compete in the Lending Game

Too many wirehouse brokers considering going independent are led to believe that once they leave their bank-owned brokerage they will no longer have access to sophisticated lending tools to offer...

Coming from a Millennial: We Want a Mentor and #Values

PFI Advisors’ Analyst, Anna Maria Garcia, suggests Millennials seek a mentor that leads with values in the beginning development of their career. “Millennials and their entry into the workforce” has...

7 Critical Steps to Becoming a Professional RIA Buyer

As conference season winds down in the wealth management industry, everyone seems to be discussing the “mega trends” that are leading to consolidation in the RIA space. From aging advisors, to...

“Lean In?” How About Simply “Don’t Lay Down”

Sheryl Sandberg’s 2013 book kicked off a public discussion on what it means to be a successful woman in the workplace, and it provided strategies and motivation…

PFI Advisors Industry White Paper: Becoming a Professional Buyer

Our latest industry white paper details the 7 key capabilities that all RIA buyers need to develop before engaging in M&A activity. This report also highlights four industry leaders and...

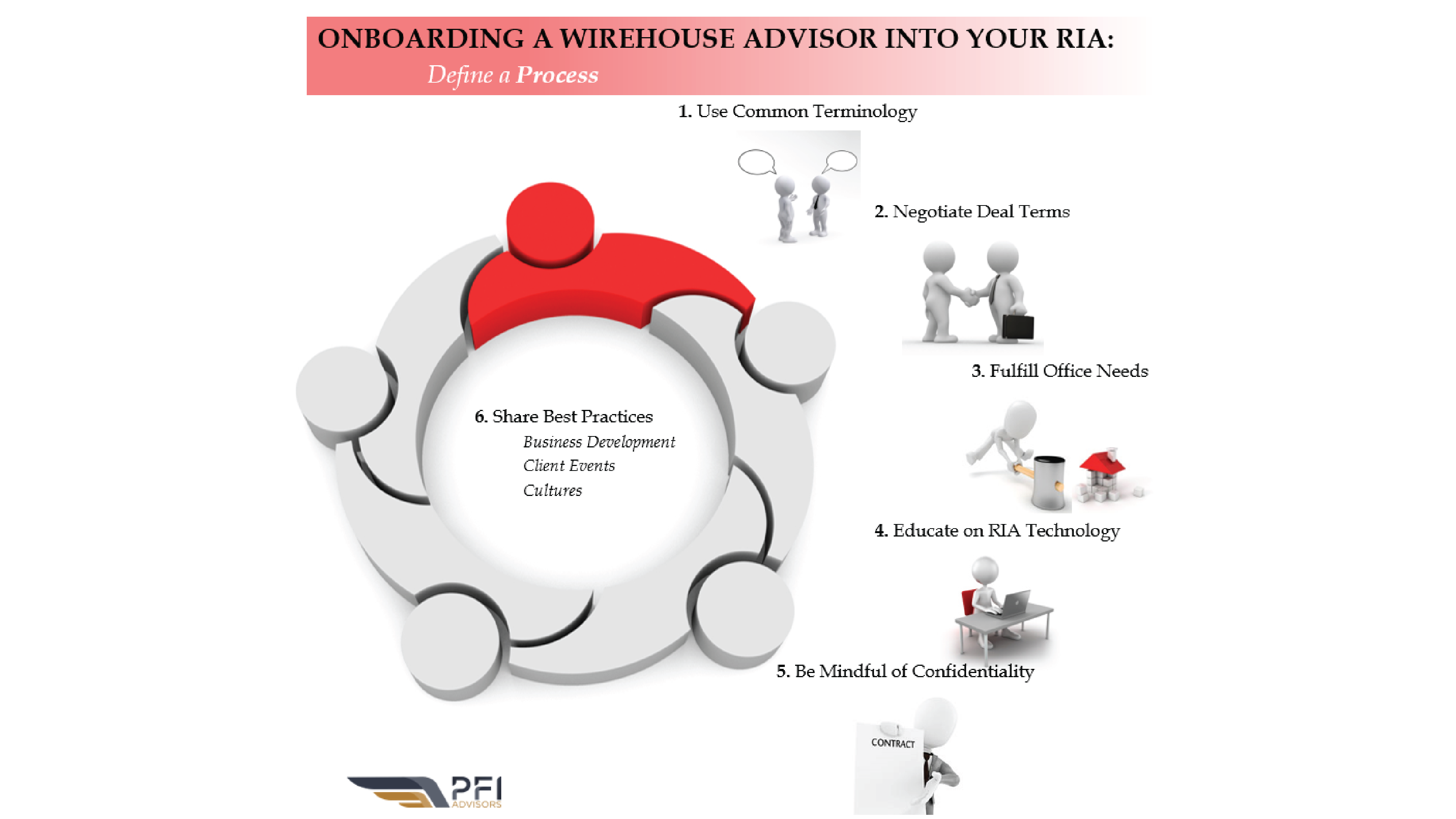

Onboarding a Wirehouse Advisor Into Your RIA

For an RIA, onboarding a wirehouse advisor or advisory team and incorporating them into your firm is an intriguing concept, but seems daunting to most. The biggest question RIAs always have...

Build It For Greatness – Not Just To Sell It

We often hear from industry experts that the end game for entrepreneurs is to build their firms so they can monetize and sell them down the road as quickly as possible. Perhaps these “experts”...

Don’t Cut Your Fees

Just Yet…

Everyone in the industry is, in our opinion, losing their mind over fee compression caused by Robo Advisors. Advisors feel they need to increase their spending on technology and cut their fee in...

You already have all the tools to beat robos. Here’s how.

When meeting with advisers in their offices, I often hear, “The average age of our client base is 67 years old. We know the statistics — 90% of children fire their parent’s adviser. We are scared to...

Tough Sales Love

for RIAs

Envestnet was kind enough to invite me to participate in a panel discussion last week at their Advisor Summit in Chicago. The topic was “Growing Your Firm’s Top Line Through The Headwinds.” I...

How My Special Needs Daughter Has Made Me a Better Entrepreneur

My wife, Larissa ("Reese"), and I launched PFI Advisors on September 25th, 2015. One month and one day later, our 6-month old daughter, Layla, had her first...

Solving Operational Issues from M&A Transactions

As the wealth management industry continues to age, the number of advisory firms that will be transitioned due to succession planning or principal retirement is expected to increase dramatically. In...

Parlaying skills into ‘Promoting Financial Independence’

With his wife, Larissa ("Reese"), as sidearm, Matt Sonnen seeks to fulfill a niche for a service level between John Furey and Shirl Penney Tuesday 1.19.16...